What is a Credit Union?

Did you know that credit unions are actually the fastest-growing alternative to banks, building societies, and doorstep/payday lenders? They may not be widely known, but their aim is to empower you to take control of your finances. They encourage you to save when you can and only borrow what you can afford to repay. The best part is that the profits made by credit unions are used to reward their members, rather than paying shareholders or big bonuses like banks and other lending businesses do.

At Eastern Savings & Loans Credit Union we offer a range of loans, savings accounts and a current account facility. Find out more about us.

Who are Credit Unions for?

Credit unions are open to everyone. You’re not just a customer, you’re a part owner. All credit unions are owned and controlled by the people who use their services. Your voice matters, and you can get involved in decision-making by attending the Annual General Meeting or other member meetings. The volunteer board of directors is elected by the members to manage the credit union. Every member’s thoughts and opinions are valued equally, regardless of their savings. Credit unions work to improve the financial health of their members. Any profits are given back to members as a dividend on their savings.

What type of savings accounts do they do?

The savings account is super flexible, allowing you to save any amount weekly, monthly, or whenever you want. You can deposit money through standing order, at the branch, or at Pay Point locations. You can even save directly from your paycheck. At Eastern Savings & Loans, the account also comes with life insurance included. If you pass away, your savings will be doubled and can be given to a person of your choice (terms and conditions apply). Our Dividend Saving Account is an instant-access savings account. You can withdraw from your savings using our online banking or telephone banking services. Learn more…

Is your money safe with a Credit Union?

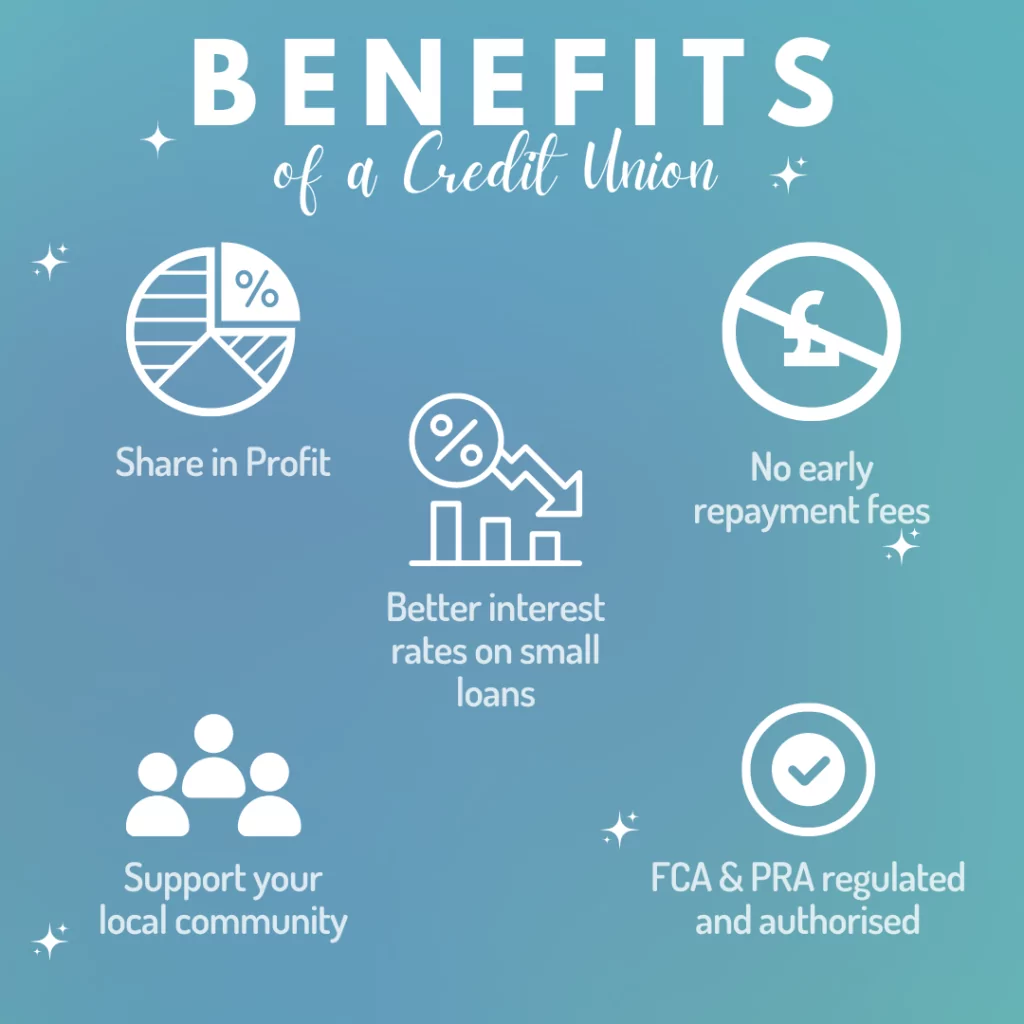

Just like banks and building societies, all credit unions are regulated by the Financial Conduct Authority (FCA) and protected by the Financial Services Compensation Scheme (FSCS). Savings up to £85,000 are protected under the Financial Services Compensation Scheme (FSCS).

Are Credit Unions just for people who are struggling financially?

No, credit unions don’t just offer one type of loan. Depending on the credit union, some of the bigger ones even offer mortgages. Take Eastern Savings & Loans for example, we’ve got loans ranging from £300 to £4,000. Credit unions are a regulated alternative to payday loans or doorstep lenders for smaller loans, and even banks for larger loans. Before you can apply for a loan, you need to join the credit union. The interest rate varies depending on how much you borrow and your personal situation. The interest is usually lower for short-term loans like payday loans. And guess what? There are some extra perks too, like no charges for paying off your loan early and even free life insurance.

You can find out more information about Credit Unions in the UK via the Find Your Credit Union Website, the Money Advice Service or Citizen Advice.